Author: Imperial

Release Time:Jan.05

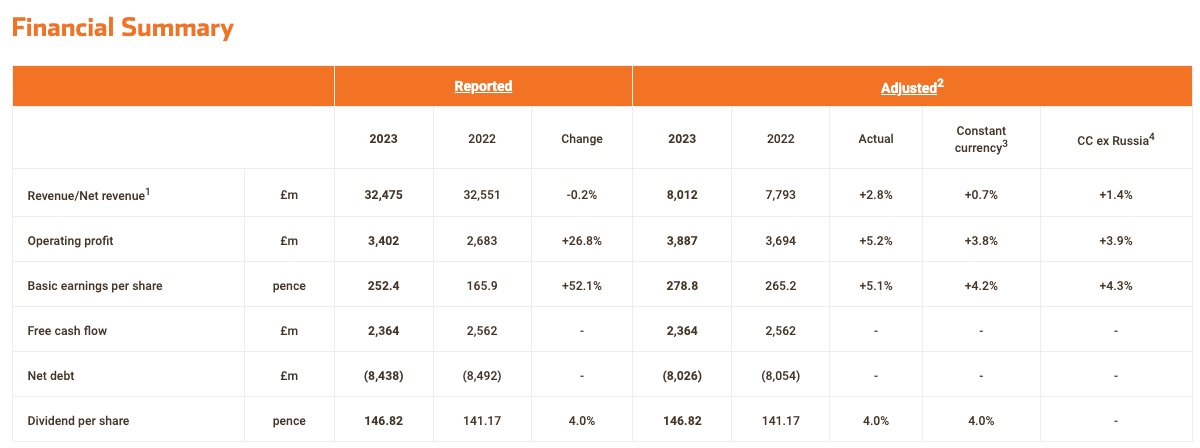

Delivered an acceleration in adjusted operating profit growth in line with five-year strategic plan.

Business Highlights

Delivered an acceleration in adjusted operating profit growth in line with five-year strategic plan.

Improved combustible tobacco performance with 10 basis points aggregate market share growth in top-five priority markets and strong, broad-based pricing gains.

Next generation product net revenue up 26% as momentum grows in all categories; Europe NGP up 40%.

Operational and financial delivery underpinned by new consumer capabilities, ways of working and cultural change, with employee engagement 100 basis points ahead of global benchmark at 74%.

Enhanced shareholder returns with 4.0% dividend increase as well as a 10% increase in share buybacks; total FY24 returns of £2.4 billion equivalent to c. 15% of total market value.

Stefan Bomhard, Chief Executive

“Three years into Imperial’s transformation, our investments in consumer capabilities, changes to the way we work, and a new performance culture are translating into stronger, more sustainable operational and financial outcomes. In combustible tobacco, improving brand equity and investment in our salesforce capabilities has led to the third consecutive year of stable or growing aggregate market share in the five priority markets which account for 70% of our operating profit. At the same time, we have offset structural volume declines with strong pricing in all key markets.

“In next generation products, our challenger approach, which combines partnership-based innovation with disciplined market entry, is delivering positive results. We now have credible propositions across all categories - vape, heated tobacco and oral nicotine. Following recent launches, we now offer consumers potentially reduced-harm choices in more than 20 European markets, as well as the United States. This step-up in investment in Europe has driven an acceleration in net revenue growth.

“Underpinning this broad-based progress is our continued transformation, which includes new innovation hubs in Liverpool, Hamburg and Shenzhen, modernisation of legacy systems, and investments in upskilling our leaders.

“All of this means we are well placed to deliver on our commitment to enhance returns to investors, with increases to both our dividend and buyback programme. Looking ahead, we expect the continuing benefits of our transformation to enable a further acceleration in our adjusted operating profit growth in the final two years of our five-year strategy. We look forward to building on our growing operational track record to deliver sustainable returns to shareholders and play a positive, distinctive role in this industry’s transition to a healthier future.”

Source:

https://www.imperialbrandsplc.com/creating-shareholder-value/full-year-results-2023

Eight in 10 respondents agree that they would be frustrated to learn that technological advances that could help address a societal issue were not made available to the public due to government inaction.

The Global Tobacco and Nicotine Forum (GTNF) took place in Seoul, South Korea 19-21 September.

Submit your E-mail to receive weekly newsletter on the

most relevant news of the E-cigarette industry.

Please Verify Your Age

Products on this website may contain nicotine and are only suitable for those who are 21 years or older.

Are you 21 or older?